There has been a huge increase of non-institutional investors who are participating in the capital markets via platforms that were designed to do the bare minimum. Beyond this, they come with privacy concerns related to the selling of order flow to bigger companies which go on to make for an uneven playing field. resulting in loss of confidence to users. We believe that more than ever, people are starting to realize they should probably get some professional help for their investments.

More complex, typically superior products are exclusively through investment advisors that tend to only offer them to ultra high net worth clients.

We change that.

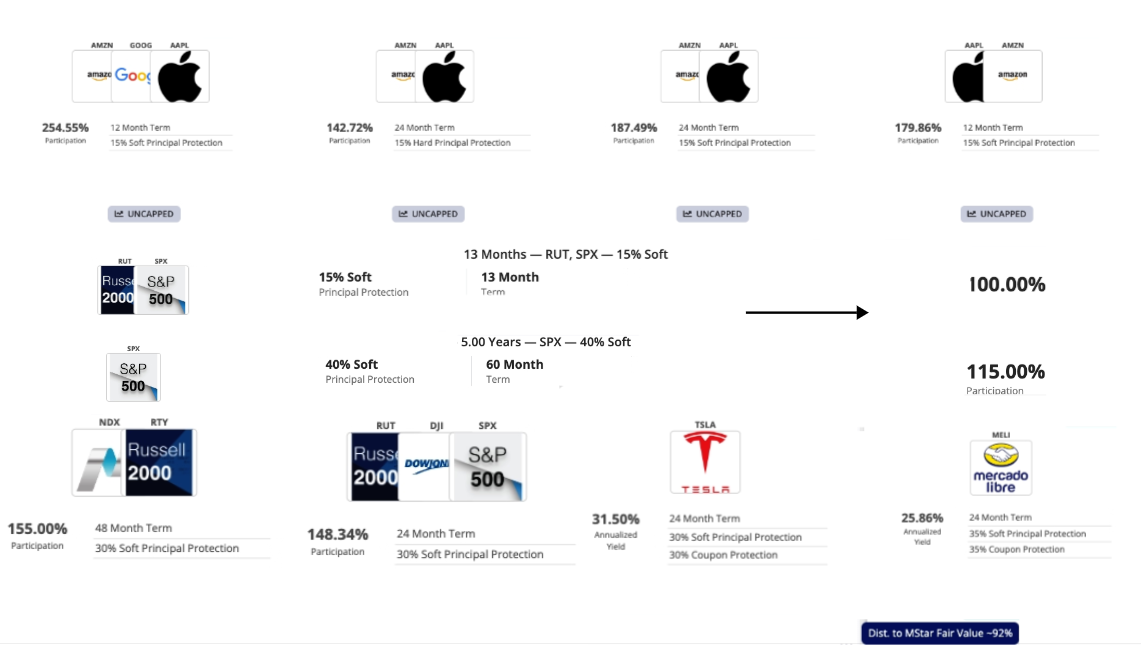

Below are some real structured quotes.

“Easy Hedge”

The structured quote is simple – 15% downside protection to Apple, Google, and Amazon and whatever performance to the upside occurs, X receives 254% of that return.

Who wouldn’t want that?

So if the worst performer out of Apple, Google, and Amazon returns 10% in the next 12 months, then X will get 25.4% or if 15% then 38.1%, respectively each 254% of actual return.

If the worst performer out of Apple, Google, and Amazon loses 10% in the next 12 months, then X will lose 0% and the same for 15%, still 0%.

The next quote shows a reward of 142% participation on AMZN and AAPL and 15% hard protection for the next 24 months.

So after 2 years if the worst performer has a total return of 10% you will receive 14.2% or if the worst performer loses 20% then you’ve only lost 5% because you were protected for the first 15%.

You’ll notice the next quote has a participation of 187%, when you trade hard protection for soft protection, you receive greater growth potential. And in the quote after that you’ll see a participation of 179 becuase it is a shorter term so you lose a bit of growth.

If single stock choices aren’t your preference, you’ll see how the quotes work for some of your favorite indexes.

There are many ways to customize your specific desires, we’re happy to show you how you can benefit from all of this and the details that go into it.

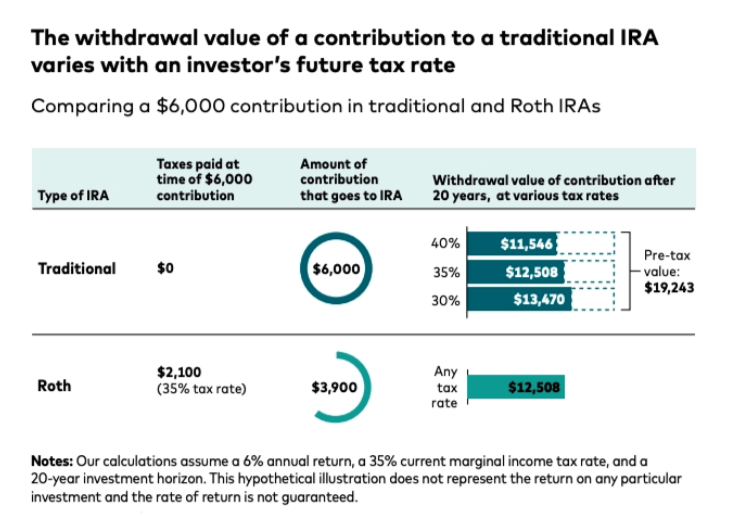

Traditional IRA, Roth IRA & Conversions – Automated

Apart from lack of annual reviews, little re-balancing, one of the most common ways advisors nowadays are ignoring their fiduciary duties intentionally or not is by avoiding roth conversions.

Roth conversions create more work to an already busy workforce however the benefits to clients can be enormous. Imagine the example below for multiple years and different tax rates:

The analysis leads to the general principle that if you expect your tax rate to be higher in the future, a Roth conversion makes sense, while if you expect your tax rate to be lower, it’s better to maintain the traditional IRA.Moreover, because future tax rates are inherently uncertain, partial conversions will give you the tax-diversification benefits of holding both types of IRAs. (In fact, most investors will benefit from tax diversification by holding taxable, tax-deferred, and Roth accounts.)

This type of analysis, however, tells only part of the story. While research generally supports this rule of thumb, there are situations where a Roth conversion may be beneficial even if your future marginal tax rate is lower than your current one. Sometimes, in fact, conversion may be attractive even if the decrease is a substantial one.

We simplify this.

Cash back investing allows easier access to the public equity markets.

Simply by spending, we facilitate an investment and align the interests of a brand, shareholders and consumers, and everybody wins.

Surveys show that 89% of people think stock ownership is more exciting than traditional rewards like points or cash back, and 65% would have told their friends about a company because of a stock reward. Now imagine being able to facilitate the process for your traditional tax deferred IRAs and Roth IRAs.