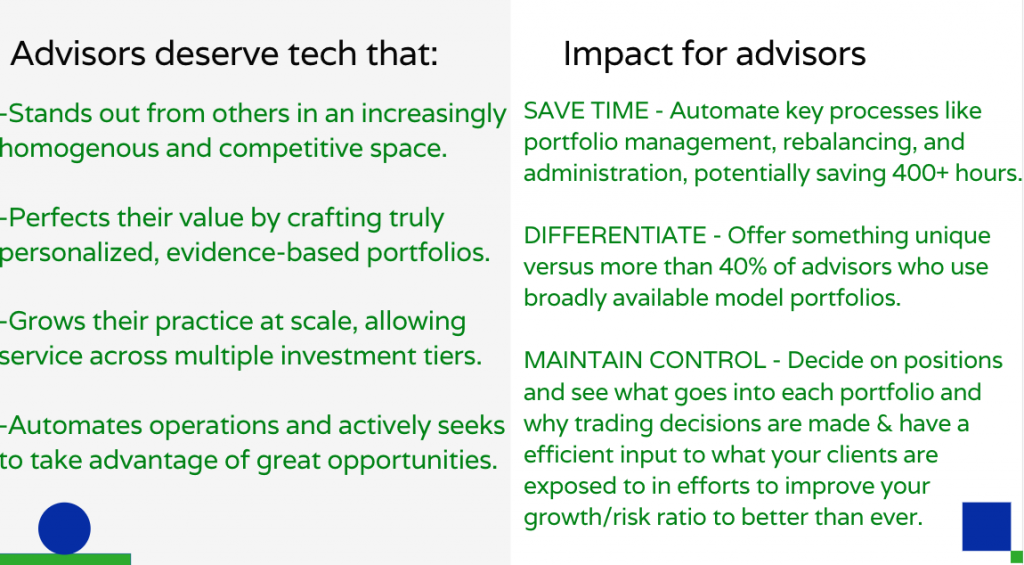

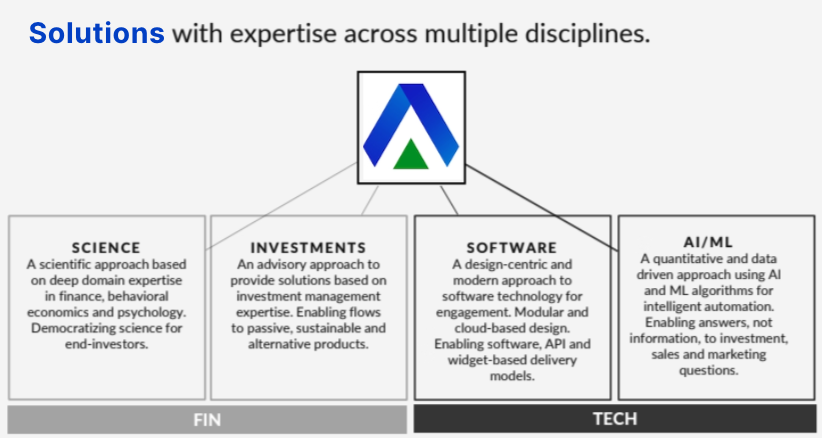

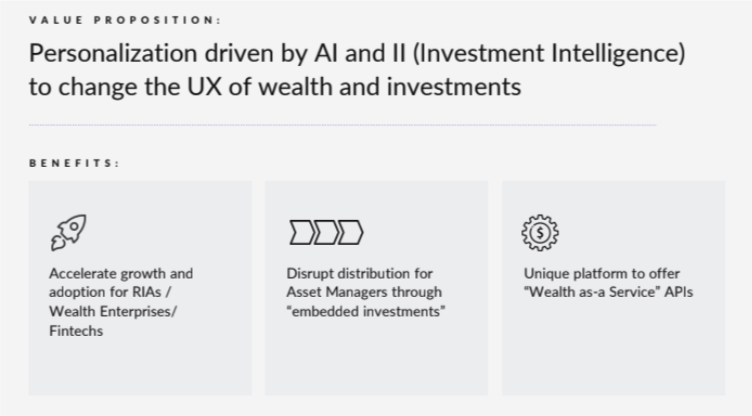

Wealth Management Platforms have been built for practice management and back-end focus but they have been unable to provide modern user experiences or build modern platforms that serve as a true one stop shop and solve the need for fewer operators creating opportunities for bundled offerings by one platform rather than multiple point solutions and vendors.

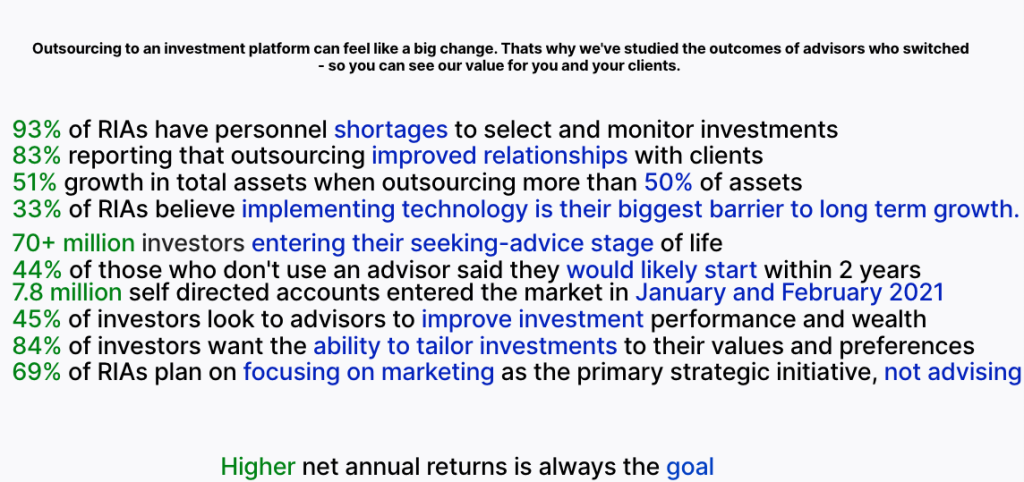

Advisors are currently neglecting their true fiduciary duty in executing the clients’ best interest because they don’t have enough time, and dedicating such time would result in lack of time for growth in strategy and obtaining new clients.

With an average age of 55, and with retirement around the corner, current incumbent wealth management owners must realize they need to keep up with the best way to do things and be increasingly open to partner with different fintech platforms leading to a difficulties with multiple point solutions and their different interfaces, bugs, log ins, updates,

and relational factors, etc.

The problem of not having everything operationally handled so you can just focus on the relationship has never been cohesively solved.

We change that.

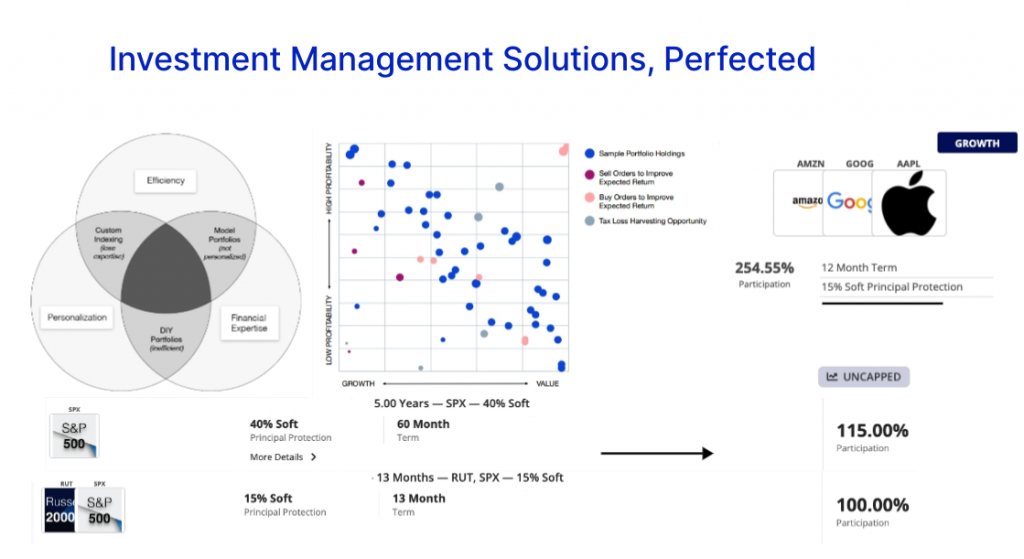

The below covers how we begin to look at direct indexing and separately, some real structured quotes.

Most advisors greatly use cookie cutter model portfolios which aren’t personalized because it’s efficient since the work has already been done via mutual funds and ETFs; the issue here has become the higher costs that get passed on to the client or that eat at operational income while not having the ability to customize holdings or trim exposure to positions you may not want for a variety of reasons.

In order to trim these expenses on mutual funds/ETFs you’d have to design the portfolios yourself, which can be incredibly inefficient for most firms because you’re either hiring a large team to do this the old school way or you’re putting together a puzzle of hiring a bunch of different vendors to help you get the job done in house. Not only is there more liability involved with this approach but perhaps this area isn’t even your strongest skill set.

The structured quote is simple – 15% downside protection to Apple, Google, and Amazon and whatever performance to the upside occurs, X receives 254% of that return.

Who wouldn’t want that?

So if the worst performer out of Apple, Google, and Amazon returns 10% in the next 12 months, then X will get 25.4% or if 15% then 38.1%, respectively each 254% of actual return.

If the worst performer out of Apple, Google, and Amazon loses 10% in the next 12 months, then X will lose 0% and same for 15%, still 0%; we’re happy to discuss all details and options.

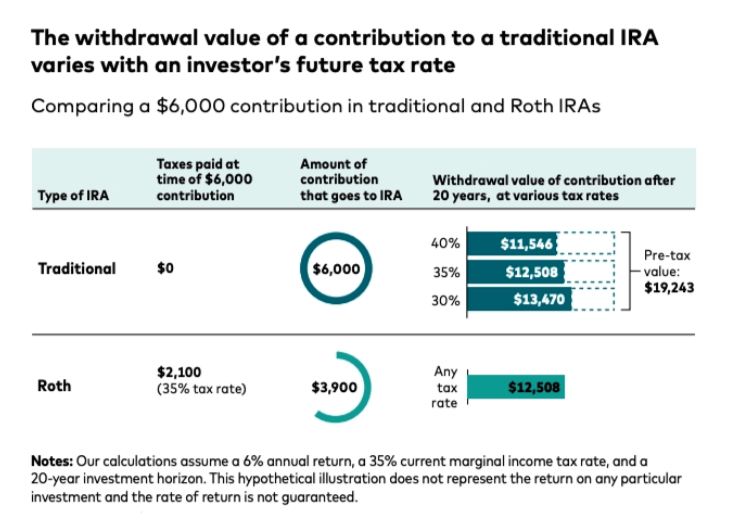

Traditional IRA, Roth IRA & Conversions – Automated

Apart from lack of annual reviews, little re-balancing, one of the most common ways advisors nowadays are ignoring their fiduciary duties intentionally or not is by avoiding roth conversions.

Roth conversions create more work to an already busy workforce however the benefits to clients can be enormous. Imagine the example below for multiple years and different tax rates:

The analysis leads to the general principle that if you expect your tax rate to be higher in the future, a Roth conversion makes sense, while if you expect your tax rate to be lower, it’s better to maintain the traditional IRA.Moreover, because future tax rates are inherently uncertain, partial conversions will give you the tax-diversification benefits of holding both types of IRAs. (In fact, most investors will benefit from tax diversification by holding taxable, tax-deferred, and Roth accounts.)

This type of analysis, however, tells only part of the story. While research generally supports this rule of thumb, there are situations where a Roth conversion may be beneficial even if your future marginal tax rate is lower than your current one. Sometimes, in fact, conversion may be attractive even if the decrease is a substantial one.

We simplify this.

& many other MAJOR breakthroughs but to summarize, we are 1 interface – For automated custom portfolio design, next-gen investment management including normal offerings but also direct indexing, Roth conversions, rebalancing, tax loss harvesting, CRM, billing, reporting, marketing, risk assessment, advanced calculators, efficient access to easy-hedge structured investing, 401k management, crypto, alternative assets, on-boarding, client education, annual review and updates, security, compliance, sales & support. Wealth as a service.